By Megan Cipperly, Senior Director, Competiscan

This is a pivotal yet confusing time for the roughly 42 million Americans who currently hold federal and private student loans.

President-elect Joe Biden has referenced multiple interventions to address the student loan debt crisis, including extending the forbearance period on federal student loans throughout the COVID-19 crisis. In addition to this relief measure, the Biden administration has previously stated that it supports canceling up to $10,000 per borrower on federal loans.

While there are no guarantees that student loan cancelation will occur in the immediate future – what impact could these potential interventions have on marketers?

Continued payment deferral, as well as student loan cancelation of federal student loans, could provide a boost for private student loan refinance lenders. Individuals that were allocating a large share of their paycheck towards paying down their federal loan debt now have more flexibility to work towards paying down their private loans. With rates low, private loan refinance offers an attractive solution.

Low rates have ensured the private student loan refinance industry will remain competitive

According to Competiscan research, in 2020 the top five student loan refi direct mail marketers were SoFi, Citizens, Earnest, Splash Financial, and Laurel Road. Lenders sent about 200 million offers in 2020. While many financial services companies decreased overall marketing activity in 2020, marketing volumes remained flat within this segment. However, we also saw some lenders take advantage of the low-interest rate environment by increasing their marketing activity. Notably, after a year of significant growth, fintech lender Splash Financial increased their presence in the mailbox by more than 300% compared to the previous year.

Credit scores matter on the APR offered

As the federal funds rate reached record lows, the average minimum fixed APR promoted on direct mailers dropped below 3% for the first time. For borrowers with fixed interest payments, this lower rate could translate to substantial savings, especially for those with good credit. In 2020 the average score of recipients of private student loan refinance mailers increased significantly. During this time, consumers with exceptional credit scores received the largest percentage of all direct mail solicitations. Competiscan anticipates that as macroeconomic conditions remain volatile, lenders will continue to concentrate their marketing efforts towards consumers with above average credit risk.

Effective campaigns clearly present the current opportunity for borrowers

Competiscan has observed that most lenders are already prominently featuring low interest rates within their most frequently used campaigns. How can lenders ensure their mail piece stands out? Based on our years of industry experience, lenders must unpack the reasons why now is the right time to refinance beyond savings. It’s likely that many borrowers will be confused as to what impact, if any, federal student loan cancellation or deferral programs will have on their private student loans. Mailers that clearly present the current opportunity for borrowers will thrive.

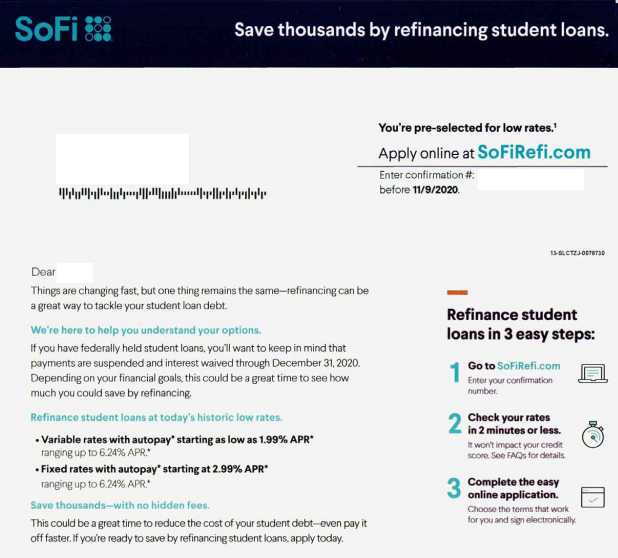

SoFi Direct Mail: “We’re here to help you understand your options. If you have federally held student loans, you’ll want to keep in mind that payments are suspended and interest waived through December 31, 2020. Depending on your financial goals, this could be a great time to see how much you could save by refinancing. Refinance student loans at today’s historic low rates.”1

Splash Financial Direct Mail: “Government relief for federal student loans was extended through the end of the year – but it still does not help people with private student loans. Pandemic life may feel more normal, but we know that your payments could be a growing source of distress. At Splash, we’re helping people like you save on their loans and find the relief they’ve been hoping for. Our rates are at historic lows. You’ve been pre-qualified to lower your rate today, so you can take control of your monthly payments and lock in savings for the life of your loan.”2

In summary, regardless of the outcome of initiatives in Washington to address student debt, refinance marketers have an opportunity to reach borrowers with timely offers extending lower rates and potential savings. However, with opportunity comes competition. Therefore, marketers that can stand out by not only offering low rates but by targeting the right prospects with clear messaging will be the most successful.

1. SoFi Direct Mail: https://www.competiscan.com/productPdf.php?id=6812157

2. Splash Financial Direct Mail: https://www.competiscan.com/productPdf.php?id=6753284